Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

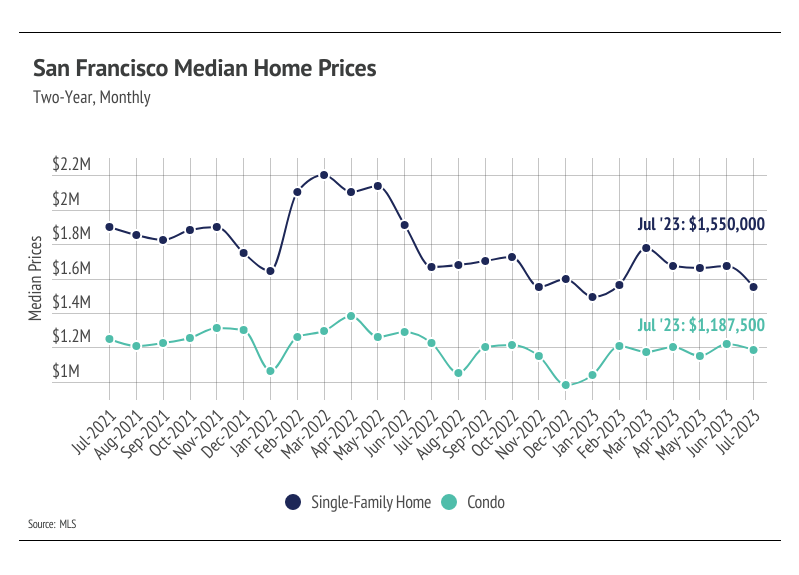

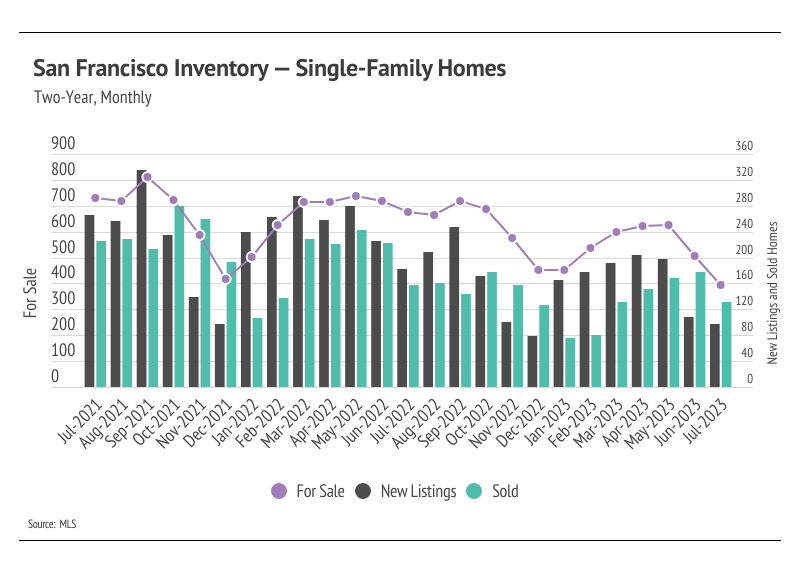

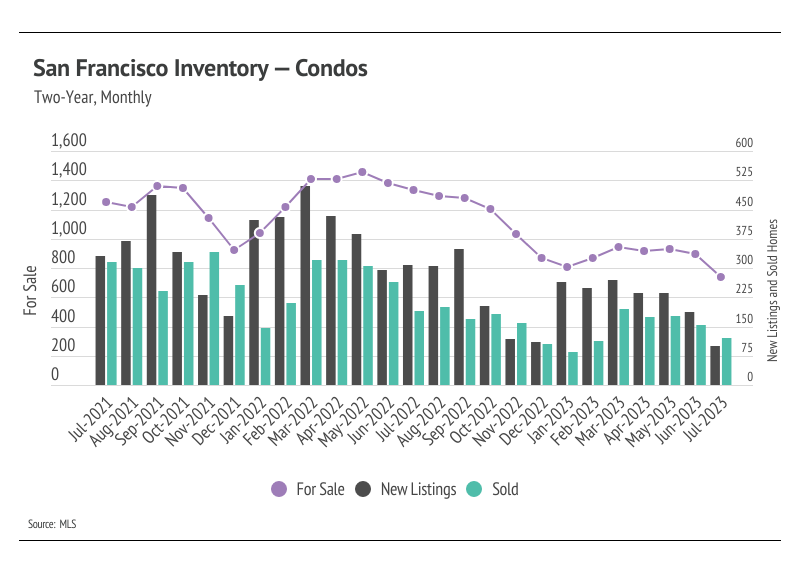

In San Francisco, the housing market is always experiencing high demand. But potential homebuyers can’t buy what’s not for sale. The lack of inventory and corresponding lack of sales has skewed price metrics. Homebuyers or homeowners bought or refinanced between mid-2020 and mid-2022 so, for example, the record $2.2 million median home that sold in March 2022 and similar homes simply aren’t on the market. Sales have dropped 42% over the past 24 months, and the average size of sold homes has decreased at the margins. Homeowners who are happy with their home aren’t selling in the current market. All this skews price data lower. San Francisco has supply issues in the best of times, but current inventory levels have almost created a market standstill.

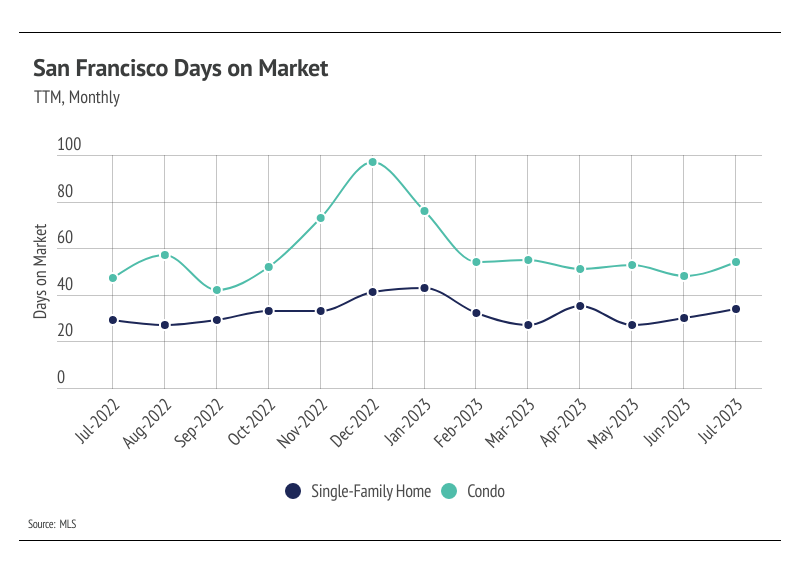

Typically, demand begins to decline this time of year, so the record low supply may become less of an issue. However, less of an issue doesn’t mean a non-issue. Quality new listings will certainly be sold quickly, while less desirable homes will sit on the market. This isn’t unusual, but it’s more apparent due to current mortgage rates. Potential homebuyers aren’t nearly as willing to pay a premium for a fixer upper as they were in 2020 and 2021.

Inventory hits all-time low

Inventory has trended lower over the past 12 months, which is far from the seasonal norm. Single-family home and condo inventory hit an all-time low in July, which further highlights how unusual inventory patterns are this year. Typically, inventory peaks in July or August and declines through December or January. Currently, inventory is so low relative to demand that any amount of new listings is good for the market. However, new listings declined rapidly in June and July, which has directly impacted both inventory and sales. The number of home sales is, in part, a function of the number of active listings and new listings coming to market. Since January 2023, sales jumped 62% while new listings fell 52%.

As tight inventory levels continue, sellers are gaining negotiating power. In January 2023, the average seller received 96% of list price compared to 99% of list in July. Inventory will almost certainly remain historically low for the year, and the market will remain competitive in the third quarter.

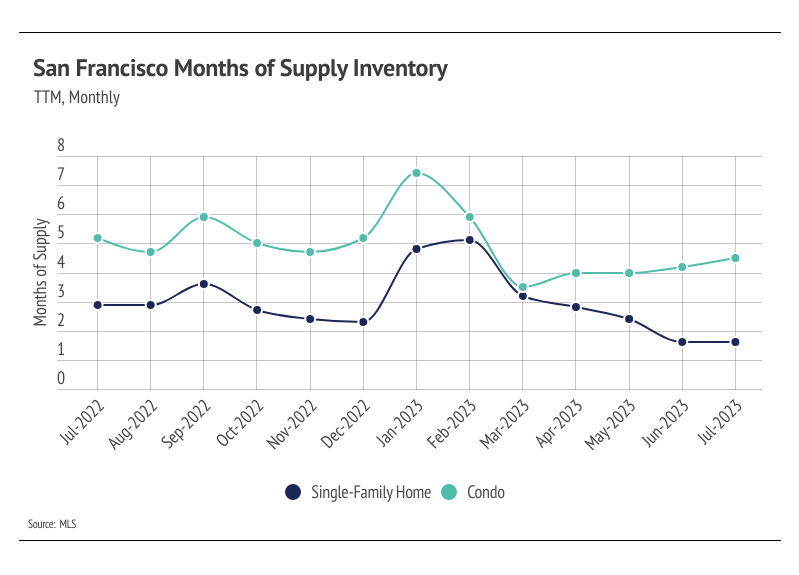

Months of Supply Inventory remained low in July

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The San Francisco market tends to favor sellers, at least for single-family homes, which is reflected in its low MSI. However, we’ve seen over the past 12 months that this isn’t always the case. MSI indicated that single-family homes and condos began the year in a buyers’ market. MSI has declined sharply since January for both single-family homes and condos, indicating that the climate has shifted from a buyers’ market to a sellers’ market for single-family homes and a balanced market for condos. The sharp drop in MSI occurred due to the higher proportion of sales relative to active listings and less time on the market.

Local Lowdown Data

If you are interested in selling, buying or just curious about the

San Francisco and Bay Area real estate market, please give me a call.

We are here to help you and anyone you care about.